Social impact bonds boost literacy and numeracy but can they scale?

Andrew Jack, Global Education Editor for the Financial Times, gathered some thrilling ideas from the lead designers and implemented the innovative financing tools for social development. He highlights the great advantages that outcome-based financing mechanisms can bring to social programs by increasing their impact and giving implementers much more flexibility to achieve them. It also shows why these tools are being criticised and what are the areas for improvement these leaders should focus on.

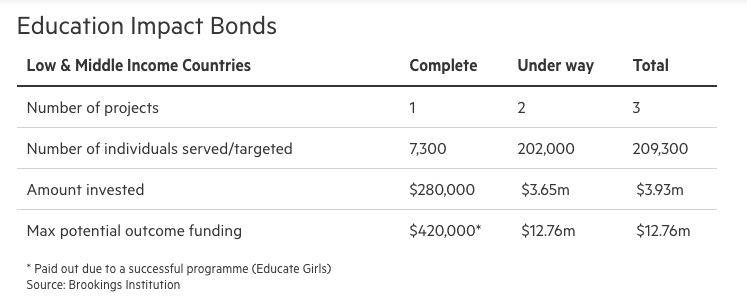

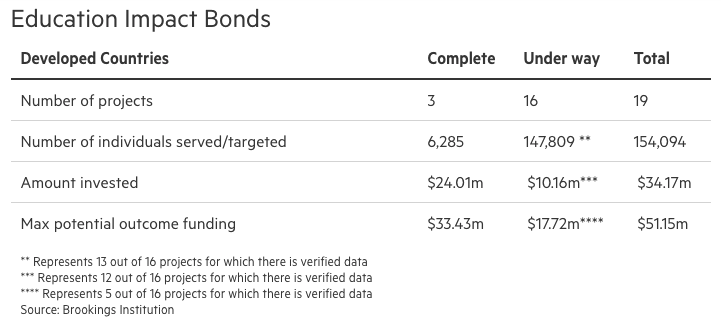

It is a decade since the UK unveiled the world’s first “social impact bond”, intended to help reduce criminal reoffending. Since then, dozens of other bonds covering various themes have appeared in multiple countries. Initiatives targeting the provision of education in lower income nations have started to become a new focus.

To their supporters, social impact bonds are a way to expand funding from the private and non-profit sectors to improve education through incentives and greater accountability. To their critics, they are a costly distraction and risk undermining approaches led by the public sector.

He mentions the Educate Girls Development Impact Bond, which was launched in 2018 as a succesfull example the impact bonds around the world.

While each bond is different, the common idea is that one or more providers bid for funding to improve the standard of education over a given period. If they achieve or exceed targets, they and their impact investor backers receive a bonus.

Systems that pay for successful results have grown in popularity and these are normally backed by international development donors, usually governments and philanthropists. Impact bonds offer the chance to increase the range of funders to those seeking a financial return.

Some of Instiglio’s closest allies in this quest for mainstream demand of these type of tools were quoted. “Impact bonds are increasingly interesting because they are focused on outcomes and come at a time when the environment is so uncertain for philanthropy,” says Phyllis Costanza, head of philanthropy at UBS, who runs the bank’s Optimus Foundation behind the two Indian initiatives. “We have found our clients who are involved in finance are really interested.”

Instiglio’s managing partner and co-founder was also cited. He explained that these tools must be designed with great care to generate good incentives that motivate all the actors involved to work and improve the lives of the vulnerable population.

“The big challenge is whether programmes will be able to maintain efficiency gains as they move towards regular streams of funding,” says Avnish Gungadurdoss, managing partner of Instiglio, a consultancy that has been pivotal in launching impact bonds.

Instiglio’s role has been to assist with technical design in order to create good incentives that enhance the entire social development environment. We tie funding to impact.