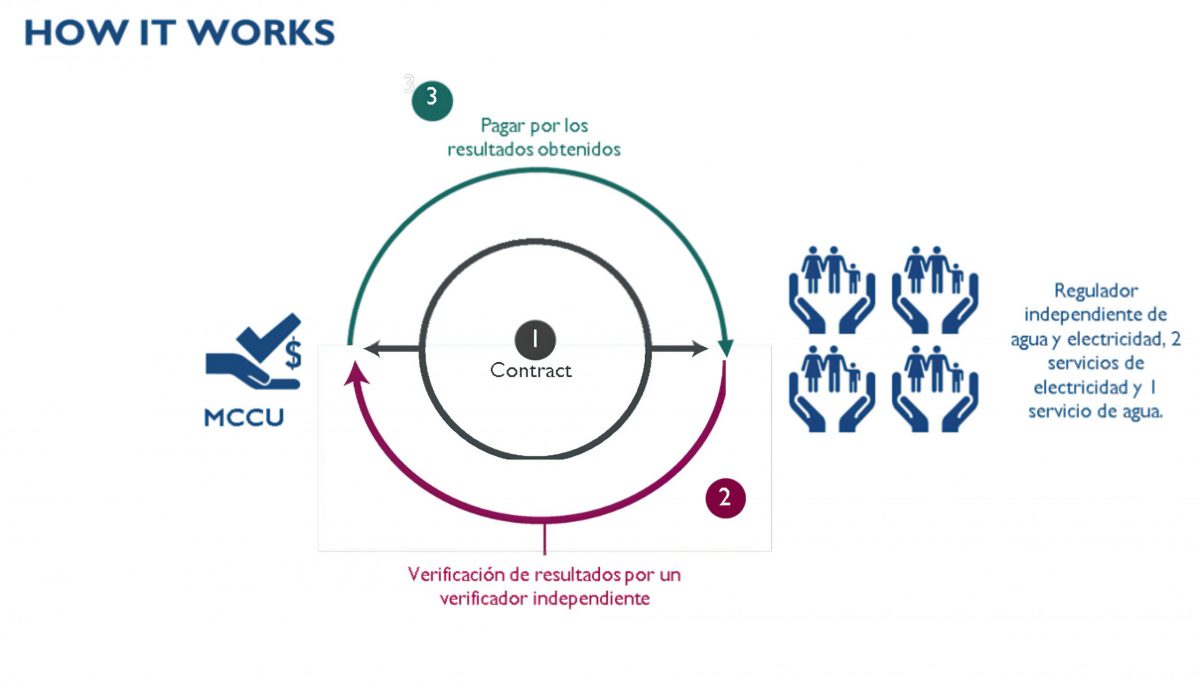

The Results-Based Financing Activity is part of the four-year Sierra Leone Threshold Program (THP) for USD 44.4 million funded by the Millennium Challenge Corporation (MCC) and implemented by the Millennium Challenge Coordination Unit (MCCU) on behalf of the Government Sierra Leone (GoSL). The program aims to lay the foundation for the effective and financially sustainable provision of essential water and electricity services by implementing policy reforms, building institutional capacity, and improving governance in the water and electricity sectors in the Sierra Leone.

Country

Sierra Leone

Timeline

2018-2020

Type of Project

Systems Strengthening

Sector

Utilities

Project

Partners

project description

In light of increasing pressure from governments and donors to achieve higher returns on social spending, the international development sector has begun to move away from traditional activity-based financing towards results-based approaches. Instiglio designed a Results Based Financing Activity (RBF) as part of the four-year, USD 44.4 million Sierra Leone Threshold Program (THP) funded by the Millennium Challenge Corporation (MCC) and implemented by the Millennium Challenge Coordination Unit (MCCU). ) on behalf of the Government of Sierra Leone (GoSL).

THP aims to create a foundation for the effective and financially sustainable provision of essential water and electricity services by implementing policy reforms, building institutional capacity, and improving governance in the water and electricity sectors in the Sierra Leone.

Instiglio, in close collaboration with the government and other industry stakeholders,

- Diagnosed the performance challenges in the four institutions,

- Identified the technical, administrative and political limitations for the successful implementation of the RBF and the corresponding mitigation strategies,

- Strengthened stakeholder capacity regarding RBF knowledge and developed four RBF designs, including payment metrics, verification, payment structure, and pricing.

In addition, Instiglio advised MCCU on the role of the regulator in the RBF, developed governance and institutional arrangements, supported the selection and onboarding of the independent verifier, and created RBF legal agreement tools to analyze performance and calculate payments during implementation. The RBF was officially launched in June 2019.

In 2019 and 2020, Instiglio supported MCCU in troubleshooting and quarterly review of verification and performance results. Finally, Instiglio developed and implemented a learning agenda during 2020 that aimed to assess the effectiveness of the RBF, the specific ways in which the RBF motivated institutional actions and drove performance improvements, and the factors that supported or limited the effectiveness of the RBF. effectiveness of the RBF.

The project is the first RBF implemented by MCC. In one of its most important sectors, it also presented an opportunity to pursue Instiglio’s goal of supporting government transformation, contributing to our expertise and creating a powerful demonstration project for our work in Africa.

Additionally, the project represented an expansion of Instiglio’s RBF work into new sectors (water, electricity and regulation), allowing us to expand our expertise in sectors that are attracting large amounts of funding and have a greater interest in RBF. It involved creating four different RBF designs tailored to the institutional context while operating on a tight deadline (approximately five months). The data-poor environment and the limited capacity of institutions prompted us to develop innovative design solutions that can be incorporated into future engagements. Lastly, Instiglio provided support throughout the lifecycle of the RBF, including implementation support and a learning agenda, allowing us to generate substantial lessons to inform the future RBF.

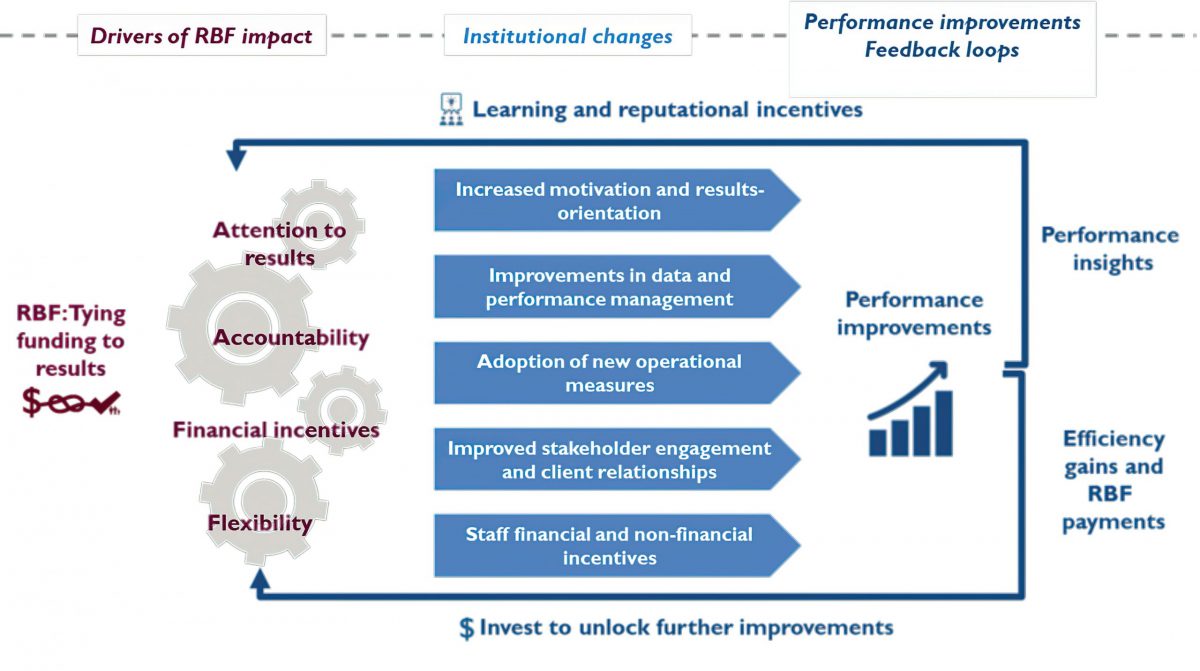

The RBF closed in May 2020 and Instiglio’s learning agenda identified a substantial impact within Sierra Leone. Both the water company and the regulator improved significantly under the RBF, achieving 114 and 90% of the ambitious targeted payment, respectively. For example, the water company improved collection efficiency by 33% (from 64% to 85%) in just one year. Qualitative evidence indicates that RBF incentives drove improvements, and institution managers and technical assistance consultants reported on the catalytic and transformative effect of RBF.

The RBF contributed to improving staff and institutional motivation, results orientation, improved performance and data management practices, and strengthened the relationship between the regulator and utilities. Performance improvement under the results-based framework reinforced this impact, catalyzing broader institutional transformation and a culture of performance.

To further demonstrate the impact of the RBF, the water utility has incorporated many features and design lessons from the RBF into its recently launched internal incentive scheme. Finally, due to the success of the RBF, the Government of Sierra Leone has expressed interest in establishing an RBF fund to channel a part of its financing to institutions conditional on the achievement of results.

As the first completed RBF, this project is the primary demonstration project for RBF within MCC, providing essential lessons for MCC’s overall RBF strategy. The project was a powerful demonstration of the value-for-money proposition that RBF provides to MCC, as MCCU has been able to redirect funds from an underperforming institution to more valuable activities.

In 2020, Instiglio conducted two workshops with government and donor stakeholders to share the results and lessons learned from the experience with the broader development ecosystem, generating increased awareness and interest in the potential of RBF within sectors. .

The project has generated important lessons on,

- RBF’s impact drivers (for example, reputational incentives had a powerful motivating effect on public institutions),

- Design features of the RBF (for example, quarterly verification and payment mitigated the negative impact of the short duration of the RBF by providing learning opportunities and allowing institutions to reinvest advance RBF payments) and

- Institutional characteristics critical to supporting the effective implementation of results-based financing (for example, institutional incentive environments more aligned with the objectives of results-based financing were a key factor).